How Does The Gerber Grow Up Plan Work?

Are you a new parent looking for a way to secure your child’s future? Or maybe you’re a grandparent who wants to give a special gift to your grandchild? Look no further than the Gerber Grow Up Plan. This innovative plan provides a way to invest in your child’s future while also providing protection for unexpected events.

So, how does the Gerber Grow Up Plan work? Essentially, it is a life insurance policy that also has a savings component. The premiums paid into the policy go towards both the life insurance coverage and the savings account, which can be accessed when the child reaches a certain age. Let’s dive deeper into the details of how this plan can benefit your family’s financial future.

The Gerber Grow Up Plan is a life insurance policy for children that provides coverage throughout their lives. The policy also builds cash value over time, which can be used for future expenses such as college tuition or a down payment on a home. Parents or grandparents can purchase the policy, and it can be transferred to the child when they reach adulthood. Coverage amounts range from $5,000 to $50,000. Premiums are based on the child’s age and coverage amount, and can be paid monthly or annually.

How Does the Gerber Grow Up Plan Work?

The Gerber Grow Up Plan is a life insurance policy specifically designed for children. It provides coverage from infancy all the way through adulthood, helping to ensure that your child is protected throughout their life. Here’s how the Gerber Grow Up Plan works:

1. Choosing a Coverage Amount

The first step in getting a Gerber Grow Up Plan is choosing the coverage amount you want for your child. You can choose any amount between $5,000 and $50,000. The premium you’ll pay will vary based on the coverage amount you choose.

Once you’ve chosen a coverage amount, you’ll need to provide some basic information about your child, including their name, age, and gender. You’ll also need to provide some information about yourself, as the policy owner.

2. Paying the Premium

After you’ve chosen a coverage amount and provided the necessary information, you’ll need to pay the premium. The premium amount will depend on the coverage amount you’ve chosen, as well as your child’s age and health.

You can choose to pay the premium monthly, quarterly, semi-annually, or annually. The longer the payment term you choose, the lower your premium will be.

3. Building Cash Value

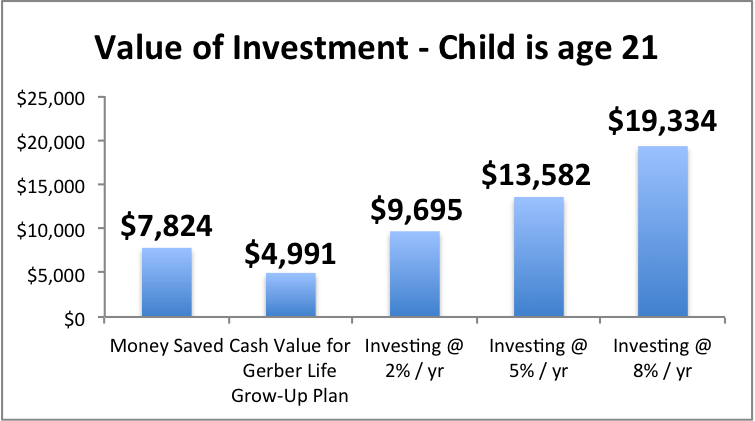

One of the unique features of the Gerber Grow Up Plan is that it builds cash value over time. This means that as you pay your premiums, the policy’s cash value will increase.

The cash value can be used in a variety of ways. For example, you could borrow against it to pay for your child’s education or use it to supplement your retirement income.

4. Choosing a Beneficiary

When you purchase a Gerber Grow Up Plan, you’ll need to choose a beneficiary. This is the person who will receive the death benefit if your child passes away while the policy is in force.

You can choose anyone as your child’s beneficiary, including yourself or another family member. You can also change the beneficiary at any time if your circumstances change.

5. Renewing the Policy

The Gerber Grow Up Plan is a renewable policy, which means that it can be renewed each year without the need for a medical exam. As long as you continue to pay the premium, the policy will remain in force.

When your child turns 21, the policy will automatically convert to a whole life insurance policy, which provides coverage for the rest of their life.

6. Gerber Life Insurance Benefits

There are many benefits to purchasing a Gerber Grow Up Plan for your child. For one, it provides peace of mind knowing that your child is protected. Additionally, the policy’s cash value can be used to help fund your child’s future goals, such as college expenses.

Another benefit of the Gerber Grow Up Plan is that it locks in your child’s insurability. This means that even if your child develops a health condition later in life, they will still be able to get life insurance coverage because they already have a policy in place.

7. Gerber Life Insurance Vs. Other Child Life Insurance Policies

While there are other child life insurance policies available, the Gerber Grow Up Plan is unique in its coverage and benefits. For example, many other policies only provide coverage until age 18 or 21, whereas the Gerber Grow Up Plan provides coverage for life.

Additionally, the Gerber Grow Up Plan builds cash value over time, whereas other policies may not. This can be a valuable asset for your child’s future.

8. Gerber Life Insurance Reviews

Gerber Life Insurance has received positive reviews from customers and industry experts alike. Customers appreciate the company’s affordable premiums and excellent customer service, while experts praise the company’s financial stability and strong ratings from independent rating agencies.

9. Gerber Life Insurance Customer Service

Gerber Life Insurance is known for its outstanding customer service. The company has a team of knowledgeable and friendly representatives who are available to answer your questions and provide assistance when you need it.

Whether you need help choosing a policy, making a payment, or filing a claim, the Gerber Life Insurance team is there to support you every step of the way.

10. Gerber Life Insurance Claims

If you need to file a claim with Gerber Life Insurance, the process is simple and straightforward. You can file a claim online or over the phone, and a claims representative will be assigned to your case.

The claims representative will guide you through the process, answer any questions you may have, and provide updates on the status of your claim. Gerber Life Insurance is committed to making the claims process as easy and stress-free as possible for its customers.

In conclusion, the Gerber Grow Up Plan is an excellent choice for parents who want to provide long-term protection for their children. With its affordable premiums, cash value accumulation, and lifetime coverage, the Gerber Grow Up Plan is a smart investment in your child’s future.

Frequently Asked Questions

Here are some common questions about the Gerber Grow Up Plan and their respective answers:

What is the Gerber Grow Up Plan?

The Gerber Grow Up Plan is a life insurance policy designed to provide coverage for a child’s future. It offers both protection and savings features, making it a great investment for parents who want to secure their child’s financial future.

The Gerber Grow Up Plan has a guaranteed death benefit that increases over time. It also has a cash value component that grows tax-deferred and can be used for future expenses like college tuition or a down payment on a home.

How does the Gerber Grow Up Plan work?

The Gerber Grow Up Plan works by providing life insurance coverage for a child. The policy is purchased by a parent or grandparent, who is the policy owner and pays the premiums.

The policy’s death benefit is paid out to the beneficiary upon the death of the insured child. The policy also has a cash value component that grows over time, which can be accessed by the policy owner for various expenses. The policy can be converted to a permanent life insurance policy when the child reaches adulthood.

What are the benefits of the Gerber Grow Up Plan?

The Gerber Grow Up Plan offers several benefits, including guaranteed coverage and a guaranteed increase in the death benefit amount. The policy also has a cash value component that grows tax-deferred, which can be used for future expenses like college tuition or a down payment on a home.

In addition, the policy can be converted to a permanent life insurance policy when the child reaches adulthood, providing continued coverage and the ability to build additional cash value.

How much does the Gerber Grow Up Plan cost?

The cost of the Gerber Grow Up Plan varies based on several factors, including the child’s age, health, and gender. Premiums are determined based on these factors, as well as the coverage amount and length of the policy.

Parents and grandparents can get a quote for the Gerber Grow Up Plan online or by speaking with a Gerber Life Insurance agent.

Who is eligible for the Gerber Grow Up Plan?

The Gerber Grow Up Plan is available for children between the ages of 14 days and 14 years old. Parents and grandparents can purchase the policy for their child or grandchild, as long as they are the legal guardian or custodian.

The child must also be a resident of the United States or Puerto Rico and meet the underwriting requirements of Gerber Life Insurance.

Gerber GrowUp Plan Review: It’s AWFUL.

In conclusion, the Gerber Grow Up Plan is a life insurance policy that is designed to provide children with financial support as they grow up. The policy’s unique feature is that it increases in value over time, which means that the longer it is held, the more valuable it becomes.

The Gerber Grow Up Plan is a wonderful way to invest in your child’s future. It provides financial security and peace of mind, knowing that your child is protected in case of the unexpected. As your child grows, the policy can be used to pay for college tuition or other expenses that may arise.

Overall, the Gerber Grow Up Plan is an excellent investment for parents who want to ensure that their child has a secure financial future. It is a smart way to protect your child’s future and provide them with the resources they need to succeed. With its unique features and benefits, the Gerber Grow Up Plan is definitely worth considering for parents who want to give their child the best possible start in life.