Can A Lien Be Placed On A Life Estate?

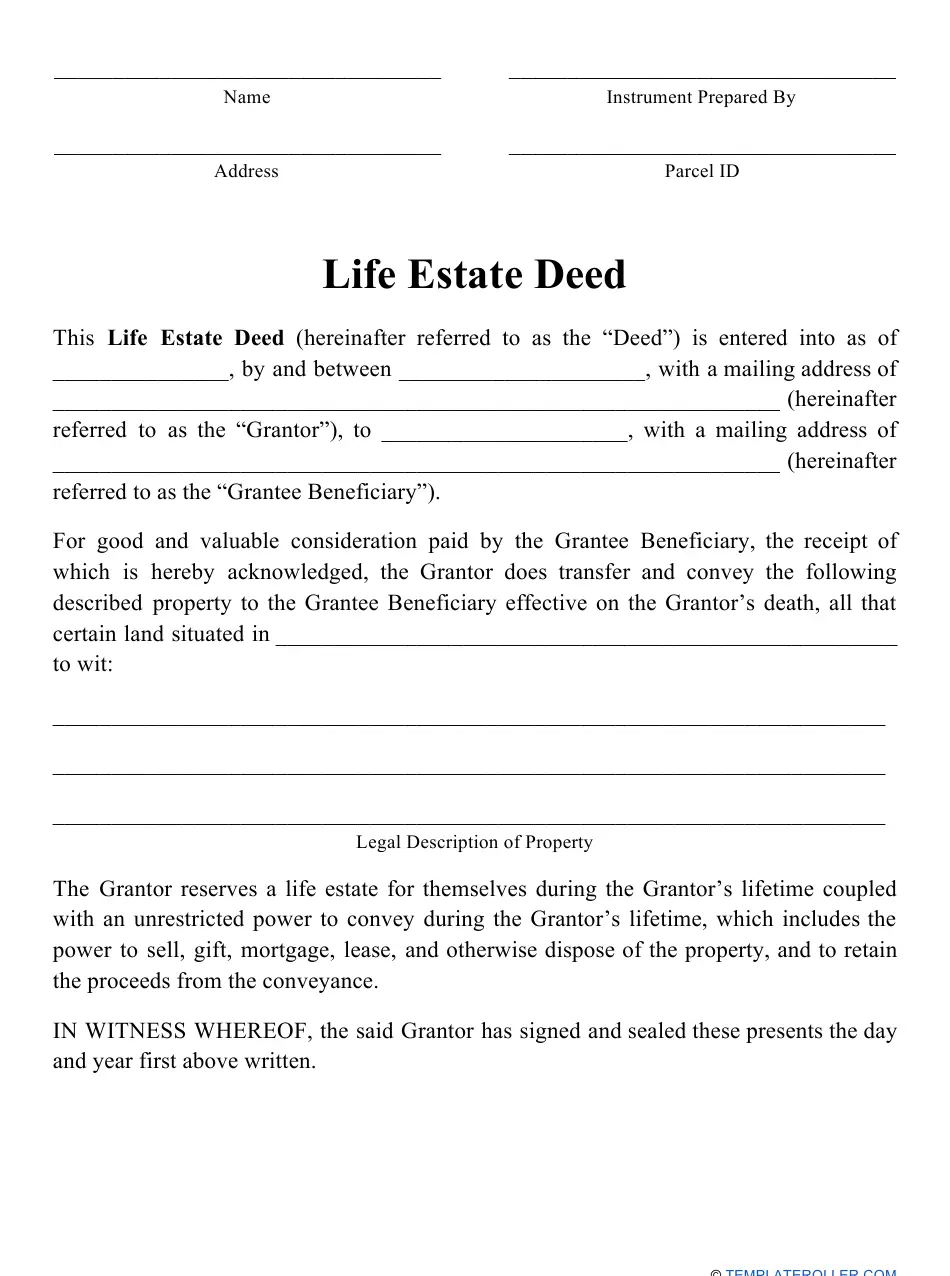

A life estate is a unique form of real estate ownership that grants a person the right to use a property for the duration of their lifetime. However, there are instances where a lien can be placed on a life estate, which can compromise the owner’s ability to use the property.

If a lien is placed on a life estate, it means that the property is being used as collateral for a debt owed by the owner. This can happen in cases of unpaid taxes, mortgages, or other debts. In this article, we will explore the intricacies of liens on life estates and what it means for property owners.

Yes, a lien can be placed on a life estate. A life estate is a type of property ownership that gives an individual the right to use a property during their lifetime. If the life estate holder owes a debt or has outstanding taxes, a lien can be placed on the property. However, the lien will only last for the duration of the life estate and will not transfer to the remainder owner once the life estate ends.

Can a Lien Be Placed on a Life Estate?

When it comes to real estate, it’s essential to understand the concept of a life estate. A life estate is a type of property ownership that gives a person the right to use a property for the rest of their life. While the life estate owner has the right to live on the property and use it, they do not have complete ownership of it. The question that often arises is whether a lien can be placed on a life estate. In this article, we will explore this topic in detail.

Understanding a Life Estate

A life estate is a legal agreement that allows someone to use a property for the rest of their life. Once the life estate owner passes away, the property will automatically transfer to the remainderman. The remainderman is the person who will inherit the property after the life estate owner’s death. In most cases, the remainderman is designated in the life estate agreement.

The life estate owner has the right to use the property as they see fit as long as they are alive. This means that they can rent out the property, live on it, or sell their life estate interest to another person. However, the life estate owner cannot sell the property outright as they do not have complete ownership of it.

Can a Lien Be Placed on a Life Estate?

The answer to this question is yes, a lien can be placed on a life estate. A lien is a legal claim against the property, and it can be used to collect a debt or satisfy an obligation. If the life estate owner owes money to someone, that person can place a lien on the life estate. The lien will remain in place until the debt is paid off, or the property is sold.

However, it’s important to note that a lien can only be placed on the life estate interest and not the remainder interest. This means that if a lien is placed on the property, the life estate owner will still be able to use the property for the rest of their life. However, the remainderman will not be able to inherit the property until the lien is satisfied.

Benefits of a Life Estate

A life estate can be beneficial for both the life estate owner and the remainderman. For the life estate owner, they have the right to use the property for the rest of their life without having to worry about it being sold or transferred without their consent. They also have the right to sell their life estate interest to someone else if they choose to do so.

For the remainderman, a life estate can be a way to inherit property without having to pay for it upfront. They will also have the assurance that they will inherit the property after the life estate owner’s death.

Life Estate vs. Trust

A trust is another way to transfer property to someone else. However, there are some differences between a life estate and a trust. With a trust, the property is transferred to the trust, and the trustee manages the property on behalf of the beneficiaries. The beneficiaries do not have the right to use the property as they see fit.

With a life estate, the life estate owner has the right to use the property, and the remainderman will inherit the property after the life estate owner’s death. The life estate owner also has the right to sell their life estate interest to someone else.

Conclusion

In conclusion, a lien can be placed on a life estate. However, it’s important to note that a lien can only be placed on the life estate interest and not the remainder interest. A life estate can be a beneficial way to transfer property to someone else, and it’s important to understand the differences between a life estate and a trust. If you are considering a life estate, it’s essential to consult with a real estate attorney to ensure that you understand all of the legal implications.

Frequently Asked Questions

What is a life estate?

A life estate is a type of ownership interest in real property that lasts only for the lifetime of the owner. After the owner passes away, the property passes to a remainderman, who has a future interest in the property.

What is a lien?

A lien is a legal claim against property that acts as security for a debt. If the debt is not repaid, the creditor can enforce the lien by foreclosing on the property and selling it to satisfy the debt.

Can a lien be placed on a life estate?

Yes, a lien can be placed on a life estate. However, the lien only lasts for the duration of the life estate. Once the life estate ends, the lien is extinguished and the property passes to the remainderman free and clear of the lien.

What types of liens can be placed on a life estate?

Any type of lien that can be placed on fee simple ownership can also be placed on a life estate. This includes mortgages, tax liens, and judgment liens. However, the lienholder’s rights are limited to the duration of the life estate.

What happens if a life tenant defaults on a lien?

If a life tenant defaults on a lien, the lienholder may foreclose on the life estate, but only for the duration of the life estate. If the life tenant passes away before the lien is satisfied, the lienholder’s claim ends and the property passes to the remainderman free of the lien.

Can Medicaid Lien My Estate?

https://www.youtube.com/embed/oPDnB9TP15A

In conclusion, it is possible for a lien to be placed on a life estate. However, the process can be complicated and varies depending on the state’s laws. It is important for life estate holders to understand their rights and responsibilities, as well as the potential risks involved. Consulting with a real estate attorney can help ensure that the proper steps are taken to protect the life estate and any liens that may be involved.

While a lien on a life estate can be concerning, it is not always a negative situation. In some cases, it may be a way to secure a loan or financial support. However, it is important to carefully consider the terms of any lien agreement and consult with a professional before making any decisions.

Overall, understanding the legal implications of a lien on a life estate is crucial for both the life estate holder and any potential lienholders. With the right guidance and support, it is possible to navigate this complex area of real estate law and protect the interests of all parties involved.