What Is A Life Estate In Florida?

If you’re a Florida resident, understanding the concept of a life estate is crucial for your estate planning. A life estate is a legal agreement that allows someone to use a property for the rest of their life, but with certain limitations on their rights as a tenant. Essentially, a life estate divides the ownership of the property into two parts: the life tenant and the remainderman.

In this article, we will discuss what a life estate is, how it works in Florida, and the various advantages and disadvantages of this type of legal arrangement. Whether you’re a property owner looking to establish a life estate or a tenant seeking to understand your rights, this guide will provide you with the necessary information to make informed decisions about your estate planning.

A life estate in Florida is a legal arrangement that gives an individual the right to use a property for the rest of their life. After the individual passes away, the property passes to a designated beneficiary. The individual with the life estate can sell or transfer their interest in the property, but the life estate terminates upon their death. This arrangement is often used in estate planning to transfer property to a beneficiary without going through probate.

Understanding a Life Estate in Florida

A life estate is a form of ownership of a property that allows an individual, called the life tenant, to use and enjoy the property until their death. In Florida, life estates are commonly used in estate planning to transfer property to beneficiaries while retaining some control over the property during the life of the grantor. In this article, we will provide a comprehensive guide to what a life estate is in Florida.

What is a Life Estate?

A life estate is a legal arrangement where the owner of a property, called the grantor, transfers ownership to another person, called the life tenant, for the duration of their life. The life tenant has the right to use and enjoy the property during their lifetime, but they cannot sell, mortgage or otherwise dispose of the property. Upon the death of the life tenant, ownership of the property is automatically transferred to another individual, called the remainderman.

A life estate is often used in estate planning to transfer property to beneficiaries while retaining some control over the property during the life of the grantor. The grantor can name themselves as the life tenant, allowing them to continue living in the property until their death, while also ensuring that the property passes to the designated beneficiaries.

Types of Life Estates

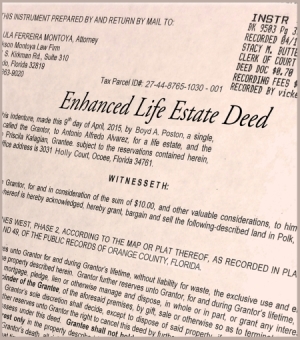

There are two types of life estates in Florida: conventional life estates and enhanced life estates. A conventional life estate is a basic form of life estate where the life tenant has full use and control of the property during their lifetime. Upon their death, ownership of the property is transferred to the remainderman.

An enhanced life estate, also known as a Lady Bird deed, is a newer form of life estate that provides additional benefits to the grantor. With an enhanced life estate, the grantor retains the right to sell, mortgage or otherwise dispose of the property during their lifetime, without the need for the consent of the remainderman. This type of life estate can be useful for individuals who want to protect their property from Medicaid liens or avoid probate.

Benefits of a Life Estate

There are several benefits to using a life estate in Florida. For example, it allows the grantor to retain some control over the property during their lifetime, while also ensuring that it passes to the designated beneficiaries. Additionally, it can be a useful tool for Medicaid planning, as it allows the grantor to transfer ownership of the property without affecting their eligibility for Medicaid benefits.

Another benefit of a life estate is that it can help to avoid probate. When the life tenant passes away, ownership of the property is automatically transferred to the remainderman, without the need for probate. This can save time and money for the beneficiaries, as probate can be a lengthy and expensive process.

Life Estate vs. Trust

A life estate is often compared to a trust, as both are commonly used in estate planning. While both tools can be used to transfer property to beneficiaries, there are some key differences between the two.

One of the main differences is that a life estate is a legal arrangement where ownership of the property is transferred to another individual for the duration of their life. In contrast, a trust is a legal arrangement where property is held by a trustee for the benefit of the beneficiaries. A trust can also provide more flexibility in how the property is managed and distributed, as the trustee can be given specific instructions on how to manage the property.

Conclusion

In conclusion, a life estate can be a useful tool for individuals who want to transfer property to beneficiaries while retaining some control over the property during their lifetime. There are several benefits to using a life estate, including the ability to avoid probate and protect the property from Medicaid liens. If you are considering using a life estate in your estate planning, it is important to consult with an experienced attorney to ensure that it is the right tool for your specific situation.

Frequently Asked Questions

How does a Life Estate work in Florida?

A Life Estate is a type of legal agreement in which a person has the right to use a property for the duration of their life. This agreement typically involves two parties, the life tenant and the remainderman. The life tenant has the right to live in the property and use it as they see fit, while the remainderman has the right to inherit the property when the life tenant passes away. In Florida, a Life Estate is often used in estate planning to help transfer property to beneficiaries while avoiding probate.

What are the benefits of a Life Estate in Florida?

One of the biggest benefits of a Life Estate in Florida is that it can help avoid probate. When property is transferred through a Life Estate, it is not subject to the probate process, which can be lengthy and expensive. Additionally, a Life Estate can help ensure that the property is passed on to the intended beneficiaries. This can be especially important in situations where there are multiple heirs or blended families.

How is a Life Estate created in Florida?

A Life Estate is created through a legal agreement. The agreement typically outlines the rights and responsibilities of the life tenant and the remainderman, as well as any conditions or restrictions on the property. To create a Life Estate in Florida, you will need to work with an attorney who can draft the necessary legal documents and ensure that the agreement meets all of the state’s legal requirements.

Can a Life Estate be terminated in Florida?

In some cases, a Life Estate can be terminated in Florida. This may happen if the life tenant fails to fulfill their obligations under the agreement, such as failing to pay property taxes or maintain the property. Additionally, the remainderman may be able to terminate the Life Estate if they can prove that the life tenant is no longer using the property as their primary residence. However, terminating a Life Estate can be a complex legal process and should only be done with the guidance of an experienced attorney.

What are the tax implications of a Life Estate in Florida?

The tax implications of a Life Estate in Florida can be complex and will depend on several factors, such as the value of the property and the estate tax laws in the state. Generally, the life tenant will be responsible for paying property taxes and maintaining the property while they are alive. When the life tenant passes away, the property will pass to the remainderman, and they may be responsible for paying estate taxes on the property. It is important to work with a tax professional or estate planning attorney to fully understand the tax implications of a Life Estate in Florida.

What Is A Life Estate? | Real Estate Exam Prep

https://www.youtube.com/embed/3dYyBqxydb0

In conclusion, a life estate in Florida is a useful legal tool that allows the holder to retain an interest in a property for the duration of their lifetime. This can be a great option for those who want to ensure that their loved ones are taken care of after they pass away or for those who want to maintain control over their property during their lifetime.

It is important to note that there are different types of life estates, each with its own unique set of rules and regulations. Understanding the details of your specific life estate is crucial in order to make informed decisions about your property and estate planning.

Overall, a life estate can provide peace of mind to property owners in Florida who want to ensure that their property is passed down as they wish. By working with a knowledgeable attorney, you can create a life estate that meets your unique needs and goals.