Does Life Insurance Cover Overdose?

Life insurance is a topic that is often shrouded in confusion and uncertainty. One common question that arises is whether life insurance covers overdose. With the current opioid epidemic and the rise in overdose deaths, it is important to understand the role that life insurance plays in this situation. In this article, we will explore the answer to this question and provide clarity on what is covered by life insurance policies when it comes to overdose. Let’s dive in.

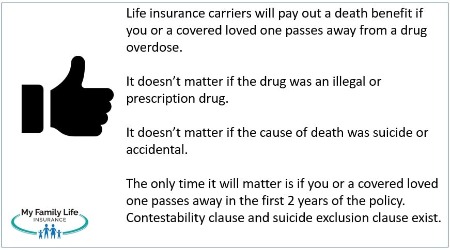

Yes, life insurance does cover overdose. However, the coverage may depend on the circumstances of the overdose, the policy terms and conditions, and the type of life insurance policy you have. Additionally, if the overdose was intentional, the policy may not pay out the death benefit. It’s important to review your policy and speak with your insurance provider to fully understand your coverage.

Does Life Insurance Cover Overdose?

Life insurance is one of the most important investments you can make to protect your family in the event of your untimely death. However, what happens if you pass away due to an overdose? Will your life insurance policy still provide coverage? This is a common question that many people ask, and the answer is not always straightforward. In this article, we will explore the intricacies of life insurance coverage for overdose and provide you with the information you need to make an informed decision.

What is Overdose?

An overdose occurs when a person takes too much of a drug or combination of drugs and experiences toxic effects that can be fatal. Overdoses can occur intentionally as a result of suicide attempts, or unintentionally due to accidental ingestion. Drug overdoses can be caused by prescription medications, illegal drugs, or a combination of both. It is important to note that not all overdoses result in death, but they can cause serious health issues and long-term effects for the individual.

According to the Center for Disease Control and Prevention (CDC), drug overdose deaths have been steadily increasing in the United States since 1999. In 2019, there were 70,630 drug overdose deaths in the United States, which is the highest number of overdose deaths ever recorded in a single year. This statistic highlights the importance of understanding how life insurance coverage works for overdose deaths.

Life Insurance Coverage for Overdose

Life insurance policies are designed to provide financial protection for your loved ones in the event of your death. However, each policy is different, and the coverage for accidental deaths can vary. In the case of an overdose death, the insurance company will typically investigate the cause of death to determine whether it was accidental or intentional. If the overdose was accidental and not a result of intentional self-harm, the policy will likely provide coverage as it would for any other accidental death.

It is important to note that if the policyholder intentionally overdosed, the policy may not provide coverage. This is because most life insurance policies have exclusions for deaths that result from suicide or intentional self-harm. These exclusions are put in place to prevent individuals from purchasing a policy with the intention of committing suicide and leaving their loved ones with financial support.

Benefits of Having Life Insurance Coverage for Overdose

Having life insurance coverage can provide peace of mind for both you and your loved ones. In the event of your untimely death due to an accidental overdose, your family will receive financial support to help cover expenses such as funeral costs, outstanding debts, and ongoing living expenses. This can help ease the financial burden on your loved ones during a difficult time and provide them with the means to move forward.

Additionally, having life insurance coverage can help ensure that your family is able to maintain their standard of living without your income. This can be especially important if you are the primary breadwinner in your household. Your life insurance policy can help provide ongoing financial support for your family and ensure that they are able to maintain their current lifestyle.

Life Insurance Coverage vs. Accidental Death and Dismemberment Insurance

Accidental Death and Dismemberment (AD&D) insurance is a type of insurance that provides coverage for accidental deaths or injuries. While this type of insurance may provide coverage for accidental overdose deaths, it is important to note that AD&D insurance is not the same as life insurance coverage. AD&D insurance typically provides a lump sum payment in the event of an accidental death or injury, while life insurance policies provide ongoing financial support for your loved ones.

Additionally, AD&D insurance policies may have exclusions or limitations on coverage for certain types of accidents, including drug overdoses. It is important to carefully review the terms and conditions of any insurance policy before purchasing to ensure that you have the coverage you need.

Conclusion

In conclusion, life insurance coverage for overdose deaths can be complex and depends on the specific terms of your policy. If the overdose was accidental and not a result of intentional self-harm, the policy will typically provide coverage. However, if the overdose was intentional, the policy may not provide coverage. Having life insurance coverage can provide peace of mind for both you and your loved ones in the event of your untimely death and ensure that they are able to maintain their standard of living. It is important to carefully review the terms and conditions of any insurance policy before purchasing to ensure that you have the coverage you need.

Frequently Asked Questions

Life insurance is an essential financial tool that provides financial security to your loved ones in case of your unfortunate death. However, when it comes to drug overdose, there are some questions that policyholders might have. Here are some frequently asked questions that can help you understand life insurance coverage for overdose.

Question 1: What is drug overdose, and how does it affect life insurance coverage?

Drug overdose is a condition that occurs when a person takes an excessive amount of drugs, leading to severe health complications and even death. In most cases, life insurance policies cover drug overdose, but it depends on the type of policy you have and the circumstances surrounding your death.

If the overdose was accidental and the policyholder did not have a history of drug abuse, most life insurance policies cover the death benefit. However, if the policyholder had a history of drug abuse, the insurance company might investigate the case to determine if the overdose was intentional or accidental.

Question 2: Can a policyholder get life insurance coverage after a history of drug abuse?

Yes, a policyholder can get life insurance coverage after a history of drug abuse, but it might be challenging and expensive. Most insurance companies consider drug abuse a high-risk factor and might charge higher premiums or exclude drug-related deaths from the policy coverage. However, some insurers offer policies designed for people in recovery, and it is essential to shop around to find the best coverage and rates.

If you have a history of drug abuse, it is essential to disclose it to the insurer and provide all the necessary information to avoid any issues with your policy’s coverage.

Question 3: What happens if the policyholder dies due to intentional drug overdose?

If the policyholder dies due to intentional drug overdose, most life insurance policies do not cover the death benefit. The insurer might investigate the case and deny the claim if they find evidence that the policyholder intentionally overdosed on drugs. However, if the overdose was accidental or due to a medical condition, the insurer might cover the death benefit.

It is essential to read the policy’s terms and conditions carefully and understand the exclusions and limitations before purchasing life insurance coverage.

Question 4: Does life insurance cover drug overdose from prescription medications?

If the policyholder dies due to an accidental overdose of prescription medications, most life insurance policies cover the death benefit. However, if the policyholder intentionally overdosed on prescription drugs, the insurer might investigate the case and deny the claim if they find evidence of intentional overdose.

It is essential to read the policy’s terms and conditions carefully and understand the exclusions and limitations before purchasing life insurance coverage.

Question 5: Can a policyholder purchase additional coverage for drug overdose?

Yes, a policyholder can purchase additional coverage for drug overdose, but it might be expensive and challenging to find. Some insurance companies offer riders that cover drug overdose, but they might have strict eligibility requirements and higher premiums.

If you are concerned about drug overdose and want to purchase additional coverage, it is essential to shop around, compare quotes, and read the policy’s terms and conditions carefully before making a decision.

?Does Life Insurance Pays Out For Deaths Due To Drug Overdose??‼️

https://www.youtube.com/embed/tfvhW3LbN7U

In conclusion, life insurance policies can provide coverage for overdose deaths, but it depends on the specific terms of the policy. While some policies may exclude coverage for deaths resulting from drug overdoses, others may provide coverage as long as the overdose was not intentional or the policy has been in effect for a certain period of time.

It’s important to carefully review your life insurance policy and understand the terms and conditions before assuming that you are covered for an overdose death. If you have questions, it’s always best to speak with your insurance provider to clarify your coverage.

Ultimately, investing in a life insurance policy is a smart decision for anyone who wants to protect their loved ones in the event of their untimely passing. By understanding the specifics of your policy, you can have peace of mind knowing that your beneficiaries will be taken care of financially.