What Is The Gerber Grow-Up Plan?

Are you a parent or a grandparent looking for a secure way to invest in your child’s future? Look no further than the Gerber Grow Up Plan. This life insurance policy not only provides financial protection for your child, but also grows with them over time.

The Gerber Grow Up Plan is a popular choice for families who want to start planning for their child’s future early on. With affordable premiums and flexible coverage options, this plan allows you to invest in your child’s future without breaking the bank. Plus, as your child grows up, the plan can be adjusted to meet their changing needs.

The Gerber Grow Up Plan is a life insurance policy designed for children that provides financial protection and savings options. The policy can be purchased by parents or grandparents for children between the ages of 14 days and 14 years. It offers guaranteed coverage that doubles in value during the child’s 18th year and can be used for anything from college tuition to a down payment on a home.

Understanding the Gerber Grow Up Plan

The Gerber Grow Up Plan is a life insurance policy that is designed to help parents provide a secure financial future for their children. It offers a combination of life insurance and savings components that can help parents build a nest egg for their child’s future. Here we will explore the ins and outs of the Gerber Grow Up Plan, and what it offers to parents and their children.

What is the Gerber Grow Up Plan?

The Gerber Grow Up Plan is a life insurance policy that is designed to help parents protect the financial future of their children. It is a term life insurance policy that is designed to provide coverage for the policyholder’s child from the age of 14 days to 18 years old. The policy provides a death benefit if the child passes away during the term of the policy.

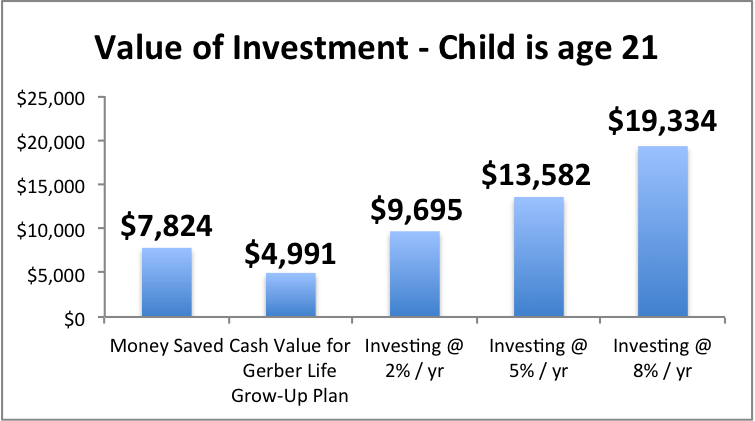

In addition to the death benefit, the Gerber Grow Up Plan also includes a savings component that can help parents build a nest egg for their child’s future. The policy’s cash value grows over time and can be used to pay for college, a down payment on a home, or any other expenses that may arise in the future.

How does the Gerber Grow Up Plan work?

The Gerber Grow Up Plan is a term life insurance policy that provides coverage for the policyholder’s child from the age of 14 days to 18 years old. The policy provides a death benefit if the child passes away during the term of the policy.

In addition to the death benefit, the Gerber Grow Up Plan also includes a savings component. The policy’s cash value grows over time and can be used to pay for college, a down payment on a home, or any other expenses that may arise in the future. The policy’s cash value is based on the premiums paid into it, and the interest earned on those premiums.

Benefits of the Gerber Grow Up Plan

One of the main benefits of the Gerber Grow Up Plan is that it provides both life insurance coverage and a savings component in one policy. This can make it easier for parents to manage their finances and ensure that they are providing for their child’s future. The policy also offers guaranteed insurability, which means that the child can purchase additional life insurance coverage as an adult, regardless of their health status.

Another benefit of the Gerber Grow Up Plan is that it is affordable. Premiums are based on the age of the child when the policy is purchased, and they are locked in for the life of the policy. This means that parents can purchase the policy when their child is young and lock in a low premium rate that will remain the same as the child grows older.

Gerber Grow Up Plan vs. other life insurance policies

The Gerber Grow Up Plan is a unique life insurance policy that offers both life insurance coverage and a savings component. This sets it apart from other types of life insurance policies, such as term life insurance or whole life insurance.

Term life insurance policies provide coverage for a specific period of time, such as 10 or 20 years. They do not include a savings component and are typically less expensive than other types of life insurance policies.

Whole life insurance policies provide coverage for the policyholder’s entire life and include a savings component. Premiums are typically higher than term life insurance policies, but the policy’s cash value grows over time and can be used to pay for expenses in the future.

Is the Gerber Grow Up Plan right for you?

The Gerber Grow Up Plan can be a good choice for parents who want to provide both life insurance coverage and a savings component for their child’s future. It is affordable and offers guaranteed insurability, which can provide peace of mind for parents.

However, every family’s financial situation is different, and it is important to carefully consider all of your options before purchasing a life insurance policy. You may want to speak with a financial advisor or insurance agent to help you determine the best policy for your family’s needs.

Conclusion

The Gerber Grow Up Plan is a unique life insurance policy that offers both life insurance coverage and a savings component. It can be a good choice for parents who want to provide for their child’s future and ensure that they have financial security. However, it is important to carefully consider all of your options before purchasing a life insurance policy to ensure that you are making the best decision for your family’s needs.

Frequently Asked Questions

Here are some common questions people have about the Gerber Grow Up Plan:

How does the Gerber Grow Up Plan work?

The Gerber Grow Up Plan is a life insurance policy that provides coverage for children. Parents or grandparents can purchase the policy for a child between the ages of 14 days and 14 years. The policy accumulates cash value over time, which can be used to help pay for the child’s future expenses, such as college tuition or a down payment on a home.

When the child reaches the age of 18, the policy automatically doubles in coverage amount. The child can then take over the policy as the owner and continue to pay the premiums to keep the coverage in force.

What are the benefits of the Gerber Grow Up Plan?

The Gerber Grow Up Plan offers several benefits, including:

- Guaranteed coverage for life as long as premiums are paid

- Accumulation of cash value over time

- Double the coverage amount when the child turns 18

- Flexible payment options and affordable premiums

- Option to add additional coverage for the child’s future

These benefits make the Gerber Grow Up Plan a popular choice for parents and grandparents who want to provide financial security for their children or grandchildren.

How much does the Gerber Grow Up Plan cost?

The cost of the Gerber Grow Up Plan depends on several factors, including the child’s age, health, and the coverage amount. However, the premiums are generally affordable and can be paid on a monthly or annual basis.

Parents or grandparents can get a free quote online or by contacting a Gerber Life Insurance agent to determine the cost of the policy for their child.

Can the Gerber Grow Up Plan be used for college savings?

Yes, the cash value accumulated in the Gerber Grow Up Plan can be used to help pay for a child’s college tuition or other education-related expenses. Parents or grandparents can withdraw the cash value or take out a policy loan to pay for these expenses.

However, it’s important to note that using the cash value for these purposes will reduce the death benefit of the policy. Parents or grandparents should consider all options before using the cash value to pay for college.

How do I apply for the Gerber Grow Up Plan?

Parents or grandparents can apply for the Gerber Grow Up Plan online or by contacting a Gerber Life Insurance agent. The application process is simple and requires basic information about the child and the policy owner.

Once the application is submitted and approved, the child will be covered by the policy and the premiums will begin. Parents or grandparents can then manage the policy online or through the Gerber Life Insurance customer service center.

Gerber GrowUp Plan Review: It’s AWFUL.

In conclusion, the Gerber Grow Up Plan is a life insurance policy designed to provide financial security for children. This plan offers many benefits, including cash value accumulation, low premiums, and a guaranteed insurability option for when the child becomes an adult.

With the Gerber Grow Up Plan, parents can have peace of mind knowing their child will be protected financially in the event of an unexpected tragedy. The cash value accumulation can be used towards future expenses such as college tuition, a down payment on a house, or even a wedding.

Overall, the Gerber Grow Up Plan is a smart investment for parents who want to ensure their child’s future financial stability. With its affordable premiums, potential for cash value accumulation, and guaranteed insurability option, it’s no wonder why this plan is a popular choice among parents.