What Is A Straight Life Annuity?

A straight life annuity is a type of retirement income plan that offers a simple and straightforward way to receive regular payments for the rest of your life. If you’re looking for a way to ensure you have a steady stream of income during your golden years, a straight life annuity may be the right choice for you.

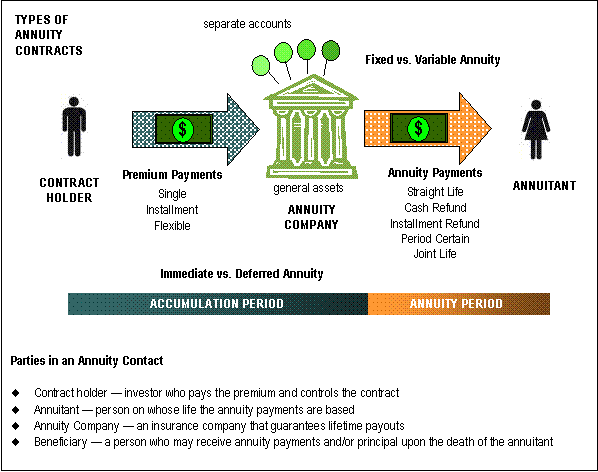

With a straight life annuity, you make a lump-sum payment to an insurance company, and in return, the insurer guarantees to pay you a fixed amount of money each month for the rest of your life. This type of annuity can provide financial security and peace of mind, but it’s important to understand how it works and its potential drawbacks before making a decision. Let’s dive deeper into what a straight life annuity is and how it can benefit you.

A Straight Life Annuity is an investment product that provides a guaranteed income for life. You pay a lump sum amount to an insurance company, which in turn pays you a fixed amount of money every month until you die. Unlike other annuities, the Straight Life Annuity does not provide any death benefits or payments to beneficiaries. It is a good option for those who want a guaranteed income stream for life and do not need to worry about leaving behind an inheritance.

What is a Straight Life Annuity?

A straight life annuity is a type of insurance contract that provides a guaranteed income for life in exchange for a lump sum payment. It is also known as a single-life annuity, and it is one of the simplest forms of annuities available. The payout of a straight life annuity is based on the life expectancy of the annuitant, and it continues until the death of the annuitant. This type of annuity is popular among retirees who want to ensure a steady stream of income for the rest of their lives.

How Does a Straight Life Annuity Work?

A straight life annuity works by converting a lump sum payment into a guaranteed income stream for life. The amount of the income stream is determined by several factors, including the age and gender of the annuitant, the amount of the initial investment, and the current interest rates.

Once the annuity is purchased, the annuitant starts receiving regular payments from the insurer. These payments continue for the rest of the annuitant’s life, regardless of how long they live. This means that if the annuitant lives longer than expected, they will receive more money, while if they pass away earlier than expected, the insurer keeps the remaining funds.

Advantages of a Straight Life Annuity

There are several advantages to purchasing a straight life annuity. The most significant advantage is the peace of mind that comes with a guaranteed income stream for life. This means that the annuitant will never run out of money, even if they live much longer than expected.

Another advantage of a straight life annuity is that it is relatively simple and easy to understand. There are no complicated investment strategies or market fluctuations to worry about, making it a good option for retirees who are looking for a stable and predictable income stream.

Disadvantages of a Straight Life Annuity

While there are many advantages to a straight life annuity, there are also some disadvantages to consider. One of the biggest disadvantages is that the annuitant gives up control of their investment once they purchase the annuity. They cannot withdraw the funds or change the payment schedule, even if their financial situation changes.

Another disadvantage of a straight life annuity is that it does not provide any death benefits. This means that if the annuitant passes away earlier than expected, the insurer keeps the remaining funds, and there is no money left for heirs or beneficiaries.

Straight Life Annuity Vs. Other Annuities

There are several types of annuities available, each with its own advantages and disadvantages. One of the main differences between a straight life annuity and other types of annuities is the payout structure.

A straight life annuity provides a guaranteed income stream for life, while other types of annuities may have different payout options, such as a fixed period or joint-life annuity. These other options may provide more flexibility or additional benefits, such as death benefits for beneficiaries.

How to Purchase a Straight Life Annuity

To purchase a straight life annuity, the annuitant will need to work with an insurance company or financial advisor. They will need to provide information about their age, gender, and investment amount to receive a quote for the annuity.

Once the annuity is purchased, the annuitant will start receiving regular payments from the insurer. It is important to carefully review the terms of the annuity contract and understand the payment schedule before making a purchase.

Conclusion

A straight life annuity is a simple and reliable way to ensure a guaranteed income stream for life. While it may not provide additional benefits or flexibility, it can provide peace of mind and financial security for retirees. If you are considering purchasing a straight life annuity, it is important to carefully review the terms of the contract and understand the payout structure before making a purchase decision.

Frequently Asked Questions

Here are some common questions you might have about Straight Life Annuity:

What is the definition of a Straight Life Annuity?

A Straight Life Annuity is a financial product designed to provide a guaranteed income stream for the rest of your life. With this type of annuity, you make a lump sum payment to an insurance company, and in return, they promise to pay you a fixed amount of money each year for as long as you live.

One of the key features of a Straight Life Annuity is that it provides a guaranteed income for life. This can be particularly appealing for retirees who are concerned about outliving their savings.

How does a Straight Life Annuity work?

When you purchase a Straight Life Annuity, you make a lump sum payment to an insurance company. In exchange, the insurance company promises to pay you a fixed amount of money each year for the rest of your life. This payment can be made monthly, quarterly, or annually.

The amount of money you receive each year is determined by a number of factors, including your age, gender, and the amount of money you contribute to the annuity. In addition, the insurance company may take into account your health and lifestyle when determining the payout amount.

What are the benefits of a Straight Life Annuity?

One of the main benefits of a Straight Life Annuity is that it provides a guaranteed income stream for life. This can be particularly appealing for retirees who are concerned about outliving their savings.

In addition, a Straight Life Annuity can help you manage your retirement income more effectively by providing a predictable source of income that you can rely on. This can be especially important if you don’t have a pension or other form of retirement income.

What are the drawbacks of a Straight Life Annuity?

One potential drawback of a Straight Life Annuity is that it may not provide as much income as other types of annuities. This is because the insurance company is taking on a greater risk by promising to pay you a fixed amount of money for the rest of your life.

In addition, if you die soon after purchasing a Straight Life Annuity, you may not receive the full value of your investment. This is because the insurance company keeps any remaining funds when the annuity owner dies.

Can you cash out a Straight Life Annuity?

It is generally not possible to cash out a Straight Life Annuity once you have purchased it. This is because the annuity is designed to provide a guaranteed income stream for life, and the insurance company needs to ensure that it has enough funds to cover the payments.

However, you may be able to sell your annuity to a third-party buyer, although this will likely result in a loss of value compared to the original investment.

In conclusion, a straight life annuity is a financial product that provides a guaranteed income stream for the rest of your life. It is an excellent option for those who want to ensure that they have a steady income during their retirement years without having to worry about market fluctuations or other risks.

While straight life annuities may not offer the highest returns, they provide a sense of security that is priceless. With a straight life annuity, you can rest assured that you will receive a fixed income every month for as long as you live, which can help you maintain your standard of living and cover your expenses during your golden years.

If you are considering a straight life annuity, it is important to do your research and consult with a financial advisor to determine if it is the right option for you. With careful planning and consideration, you can ensure that your retirement years are comfortable and worry-free.