Does Life Insurance Cover Drug Overdose?

Life insurance is a crucial investment that provides financial security to individuals and their families in case of any unforeseen circumstances. However, when it comes to drug overdose, there is a common question that arises – does life insurance cover drug overdose?

Drug overdose can be a tragic incident that can leave families devastated and struggling to cope with the loss. In this article, we will explore the topic of life insurance coverage for drug overdose and provide some valuable insights into what is covered and what is not. So, let’s delve deeper into this topic to understand how life insurance can help in case of a drug overdose.

Life insurance typically covers drug overdose, as long as it is not a suicide attempt. However, if the policyholder had a pre-existing condition or was under the influence of drugs or alcohol, the claim may be denied. It is important to review the policy terms and conditions carefully before purchasing life insurance to ensure that drug overdose is covered.

Does Life Insurance Cover Drug Overdose?

Drug overdose is a growing epidemic that has affected millions of people worldwide. In 2019 alone, the National Institute on Drug Abuse reported over 70,000 drug overdose deaths in the United States. With these staggering numbers, it’s important to understand if life insurance covers drug overdose.

What is Life Insurance?

Life insurance is an agreement between an individual and an insurance company, which pays out a sum of money to the individual’s beneficiaries upon their death. The beneficiaries can use the money to pay for expenses such as funeral costs, debts, and living expenses. There are two main types of life insurance: term life insurance and permanent life insurance.

Term life insurance provides coverage for a specific period of time, typically 10, 20, or 30 years. If the individual dies during the term, the beneficiaries receive the death benefit. Permanent life insurance, on the other hand, provides coverage for the individual’s entire life and typically has a cash value component that can be borrowed against or withdrawn.

Does Life Insurance Cover Drug Overdose?

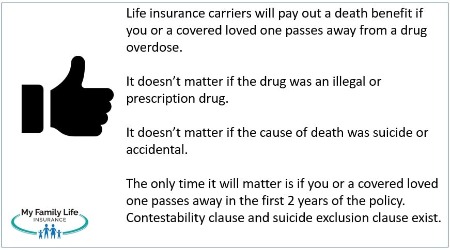

Life insurance policies typically cover drug overdose, but there are some exceptions and limitations. If the individual dies due to a drug overdose, the beneficiaries will receive the death benefit as long as the policy was in force and the premiums were paid. However, if the individual died as a result of a drug overdose and it was determined that they intentionally took the drugs with the intent to harm themselves, the death benefit may be denied.

It’s important to note that some life insurance policies may have a clause that excludes coverage for drug overdose during the first few years of the policy. This is known as the contestability period, which is typically the first two years of the policy. During this time, the insurance company has the right to investigate and deny claims if they find that the individual provided false information on their application or if there was fraud involved.

Benefits of Having Life Insurance

Having life insurance provides peace of mind knowing that your loved ones will be taken care of financially in the event of your death. The death benefit can be used to pay for expenses such as funeral costs, debts, and living expenses. It can also be used to provide for your children’s education or to leave a legacy for future generations.

Additionally, some life insurance policies have a cash value component that can be used as a source of savings or investment. This cash value can be borrowed against or withdrawn to pay for expenses or to supplement retirement income.

Life Insurance vs. Accidental Death and Dismemberment Insurance

Accidental Death and Dismemberment (AD&D) insurance is a type of insurance that pays out a benefit if the individual dies or is dismembered as a result of an accident. Unlike life insurance, AD&D insurance does not cover death or dismemberment due to illness or natural causes.

While AD&D insurance may seem like a good option for those who engage in risky activities, it’s important to note that it’s not a substitute for life insurance. Life insurance provides coverage for a wide range of causes of death, including illness and natural causes.

Conclusion

Life insurance can provide financial protection for your loved ones in the event of your death, including death due to a drug overdose. However, it’s important to read the policy carefully and understand any limitations or exclusions. If you or someone you know is struggling with drug addiction, seek help immediately to prevent the risk of overdose.

Frequently Asked Questions

What is drug overdose?

Drug overdose occurs when a person takes an excessive amount of a drug or multiple drugs which can lead to severe health problems or even death. Overdose can be accidental or intentional.

It is important to note that some drugs are more likely to cause overdose than others. Examples of these drugs include opioids, benzodiazepines, and stimulants.

Is drug overdose covered by life insurance?

Whether or not drug overdose is covered by life insurance depends on the specific policy and circumstances surrounding the overdose. In some cases, if the policyholder dies as a result of a drug overdose, the death benefit may still be paid out to the beneficiary.

However, it is important to note that if the policyholder knowingly and intentionally overdoses on drugs, the life insurance company may not provide coverage. It is always best to review your policy and speak with your insurance provider to understand the specific terms and conditions of your coverage.

What is accidental death insurance?

Accidental death insurance is a type of insurance policy that provides coverage in the event of an accidental death. This type of policy may provide coverage in addition to a standard life insurance policy.

Accidental death insurance may be a good option for individuals who work in high-risk jobs or engage in high-risk activities. This type of policy can help provide financial protection for your loved ones in the event of an unexpected and tragic accident.

What are exclusions in a life insurance policy?

Exclusions in a life insurance policy are specific circumstances or events that are not covered by the policy. These exclusions can vary depending on the insurance company and the specific policy.

Examples of exclusions that may be included in a life insurance policy include suicide, death resulting from illegal activities, and death resulting from a pre-existing condition that was not disclosed when the policy was purchased.

What should I consider when purchasing life insurance?

When purchasing life insurance, there are several factors to consider. These factors include the amount of coverage you need, the type of policy that is best for your situation, and the cost of the policy.

It is also important to consider your current financial situation, any debts or financial obligations you have, and the needs of your beneficiaries. Working with an experienced insurance agent can help you navigate the process and find the best policy for your needs.

?Does Life Insurance Pays Out For Deaths Due To Drug Overdose??‼️

https://www.youtube.com/embed/tfvhW3LbN7U

In conclusion, it is important to understand that not all life insurance policies cover drug overdoses. Some policies have exclusions for deaths related to drug use, while others may provide coverage but with certain limitations.

If you are considering purchasing life insurance and have a history of drug use or addiction, it is important to disclose this information to your insurance provider. This will ensure that you fully understand the terms of your policy and can make informed decisions about your coverage.

Ultimately, the best way to protect yourself and your loved ones is to seek help for any addiction issues and take steps to maintain a healthy lifestyle. Life insurance can provide financial security for your family in the event of your untimely death, but it is only one piece of the puzzle when it comes to ensuring a stable and secure future.